What Is Wise?

Wise, formerly known as TransferWise, is a global financial technology company that offers a more cost-effective and transparent way to send, receive, and manage money across borders. Founded in 2011 with a mission to make international money transfers cheap, fast, and easy, Wise provides a multi-currency account that allows users to hold, convert, and spend money in multiple currencies at the real exchange rate. This innovative platform sidesteps traditional banking fees by matching currency flows between users in different countries, thereby reducing the cost of transactions. Today, Wise is widely recognized for its straightforward pricing, user-friendly interface, and commitment to financial transparency, making it a popular choice among travellers, expatriates, and businesses looking to manage their global finances efficiently. Wise facilitates transactions in over 50+ currencies.

Why Wise Is Important For The Caribbean

Now we know that being able to send and receive money is crucial for the Caribbean as many of us have clients, family or friends that are always looking to send money to us. We know that platforms like Western Union and Moneygram take a lot of time out of our doing using their services due to long lines and the common complaint is it costs too much money to use their services. We in the Caribbean need a cost and time-effective way to send and receive money and this is where having a Wise account can help us tremendously.

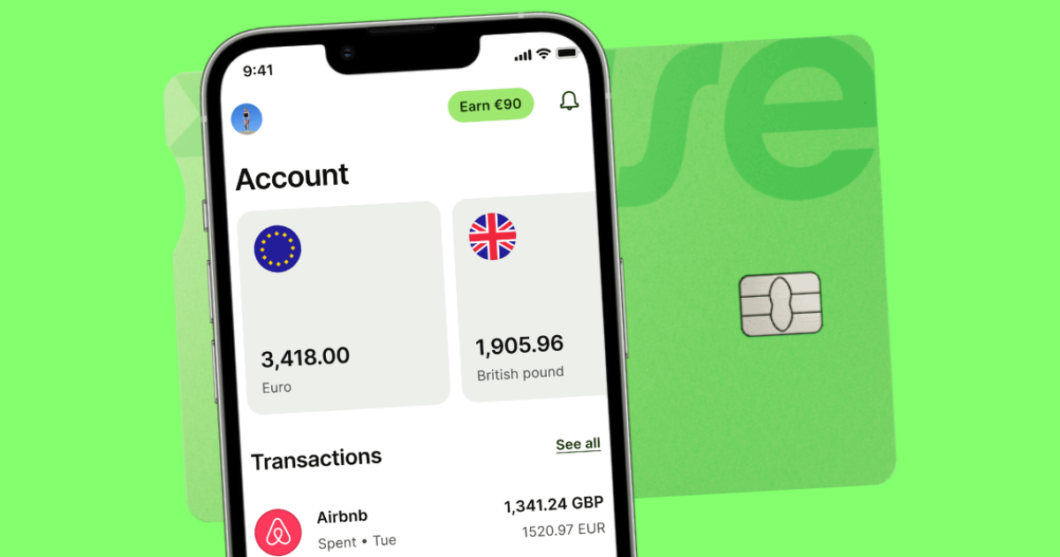

Basically, you can set up multiple digital bank accounts in whichever currency you want (once it’s supported by Wise) and you will get the banking details (account number, Chequing, Routing, ACH, Swift) so that you can conduct your business. You would provide clients, family or friends with those details and they will be able to send you the funds to your digital bank account with Wise.

I believe one of the most important aspects of Wise, especially if you are living in Trinidad and Tobago, is the Wise Physical and Digital cards. These cards allow you to use the money that is in your Wise account, anywhere in the world once a credit card is accepted and also use them online to shop or to conduct your business.

In the case of Trinidad and Tobago where we have a Forex shortage and simply have limited access to currencies like USD, this will allow your funds never to come into the T&T banking system, where you will not be subjected to heavy limitations in Trinidad and Tobago.

Wise is also a great platform for us to use in the Caribbean because this is another great way for us to move money across each border, sending/receiving funds from other Wise users.

How To Set Up a Wise Account

To get the best of Wise while living in the Caribbean, it is best to have a family or friend’s address living in countries like the UK, Canada, etc. They have restricted giving out key things like the Wise Cards to Caribbean accounts. Getting permission and using an address outside of the Caribbean, will give you access to the cards and you will be able to use the cards anywhere in the world.

How to set up the account:

- Go to Wise.com

- Click Register

- When you begin filling out your information, put the address of your Family/Friend outside of the Caribbean. It’s best to use someone’s address outside of the US, as US addresses will require you to provide proof of address. If you don’t have proof of US address, use friends/family in a different country.

- Wise will need you to verify your ID with your local documents (National ID, Passport, Drivers License)

- You will then be asked to Confirm Your SSN…Select “I’m not a US Citizen and Don’t have an SSN“

- On the main screen…Click on “Open – Explore Ways to spend, save and grow your money“.

- Choose the Currency you would like to have an account…ex US, Cad, etc.

- You will be charged an opening fee of $20usd to open the account which you can pay via Credit Card, Wire Transfer and a few other options. Pick whichever one is suitable for you. The $20usd will be placed in your account for you to use afterward.

- Once your account is opened, you can click on the Currency in your Main Screen, You will see a Bank logo with an account number, once you click on it, the screen will load up with all of your banking details for that account.

After you set up the various currencies that you want, I suggest clicking on “Card” on the main menu, it will then present you with the options for both the Digital and Physical Cards.

The Digital Card is free and available to create immediately.

The physical card needs to be mailed out to you. Select the physical card, It will ask you for the DELIVERY ADDRESS and this is where you can put in your home address in the Caribbean country you are living in, if you would like the card to be mailed to your address, you can have it mailed to the same friend or family’s address that you used upon setting up the account, if you know you are going to be seeing them soon or they can mail it to you.

*Disclaimer…I had to pay $20usd for my physical card, this is in addition to setting up the account but I have seen others that did not get charged for the Physical card. Be prepared to pay for it and if they don’t charge you for it, great.

*If You ALREADY have an account With Wise – You will need to change your address to gain access to the cards. Make sure you use a friend/family address outside of the Caribbean. Id recommend using someone’s address outside of the US because US addresses will trigger Wise to ask you for proof of address, if you have something with your name on it from the US, go through with it. If you DO NOT have your name on something with a US address, try using someone from the UK/Canada, as Wise will not ask for proof of address with those countries and you will gain access to the Wise Cards.

If you DO NOT change the address and Wise still has your Caribbean address, it will tell you the cards are not available for your country.

**Update** Wise now requires you to provide a proof of address for any country that you use when registering. This change happened in January 2025. If there is another way to go about creating a Wise account in the future, I will update this post again. As of right now, you will need to provide proof of address to create the account. Some people will be able to get their hands on a proof of address in their name in another country, those people will be able to get Wise accounts. If not, you won’t be able to create the account.

This is how your bank details will be provided to you.

How To Fund The Wise Account/Card

There are several ways to fund your Wise, in which you can then deposit the funds to your local bank account, keep the funds in Wise to use their Bank cards or use Wise to do cross-border payments instead of using the Banks.

Here are the various methods:

- Use your Credit Card to add funds to the Wise account

- Wire Transfers from your bank

- Use Western Union’s Direct-to-bank deposit…Bring your Wise account details to Western Union and they will do a direct deposit into the Wise account.

- Give Friends/family/clients from around the world your Wise banking details and they can send Wire Transfers to the account

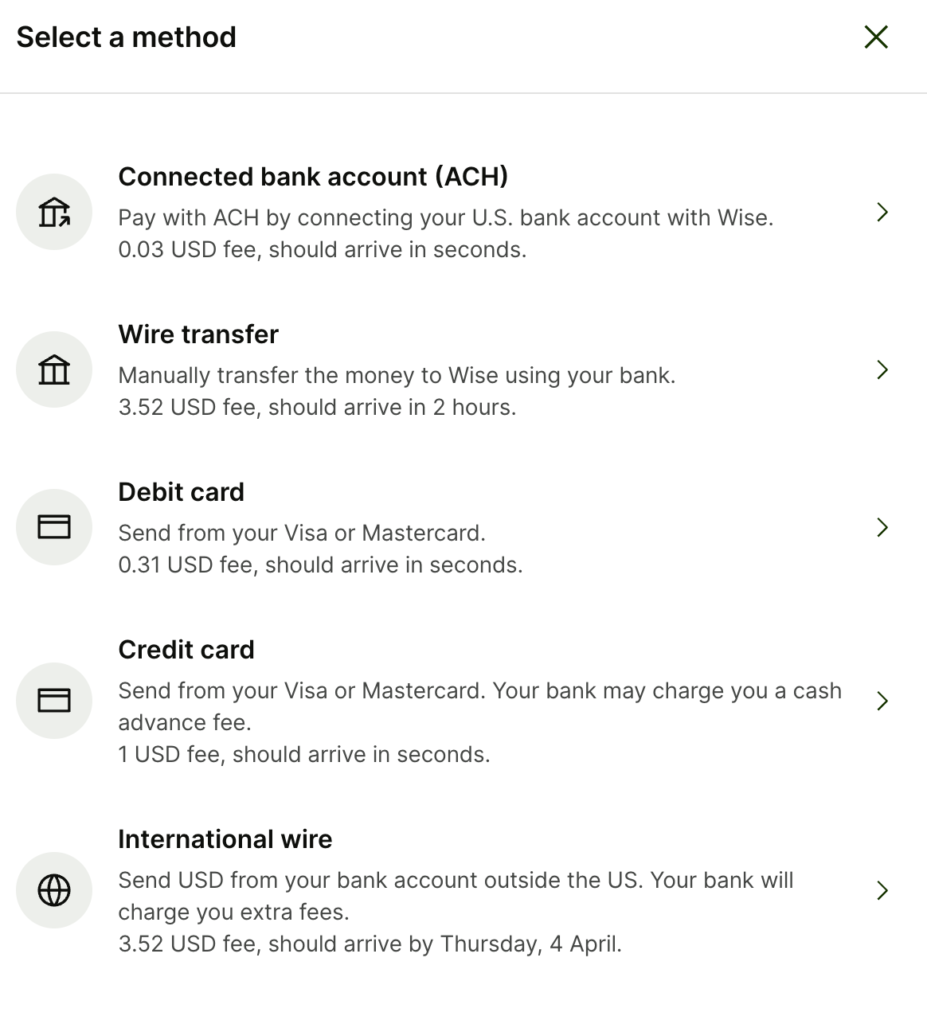

Check the image below for more details. You can select which method to fund your wise account that makes sense for your situation. At a bare minimum, if you aren’t able to use any of the details below, as I said earlier, visit Western Union with your Wise account details and they will do their Direct-to-bank deposit. This method takes 1-5 business days for the funds to show up in the account. It took 1.5 days when I sent the money from Western Union to my account.

Sending Money To Another Bank Account in a Different Country

- Load money into Wise account

- Add bank account from another country as a “Recipient” and fill out account details.

- Click Send and select the account you want Wise to Wire Transfer the money to

*You also have the option of just leaving the money in your Wise account and using your Wise card to make payments online to buy goods, services or pay suppliers if they accept credit card payments.

Sending Money To Another Bank Account in the Caribbean

- Load money into Wise account

- Select Add Recipient

- Select USD Currency

- Select Enter Bank Details

- Select Myself or Someone Else

- Under “Bank Details” Select Swift

- Fill in all information and you will need to get the Swift code number from your bank

- Enter your account number from your bank account

- Select confirm

When you have money in your Wise account wallet, you can click Send…Select the Persons name or your account.

Select how much money you want to send to that account and it will be transferred over to any bank account in the Caribbean.

The Card Limits

To View or Change the limits of your Card…Select Card on the left-hand side menu.

Select “Edit Limits”

The Limits are as follows:

ATM withdrawal limits – Daily limit — 5,100 USD and Monthly limit — 5,100 USD

Spending Limits – Daily Limit – 41,000 USD and Monthly limit – 41,000 USD

When you have your cards…This is how your Card Screen will look.

Connecting Wise To PayPal

Connecting your Wise Bank account to PayPal is simple.

- Log into PayPal

- Go to Account Settings

- Select Money, Banks, and Cards

- Select “Link New Bank Account”

- Go to your Wise account and get your bank details for your currency account

- Under the local tab (See 1st Image in this article), add all of that information into PayPal (see Link US Bank Account image Below)

- PayPal will then tell you it will deposit 2 small deposits to the account to confirm the account

- When you receive those deposits into your Wise account (which takes 2-3 days), enter those numbers into PayPal and that will confirm the account.

Now if you receive funds from Clients, Friends or Families using PayPal, you can deposit those funds into your Wise account and use the funds with the Wise cards.

If you are a Business Owner, getting paid by clients using PayPal and you want the funds to go to your local business accounts with your home banks, simply add your business accounts as a recipient inside of Wise. In order to deposit funds from Wise to Local Banks in the Caribbean, you must use the Swift network and NOT Wire or ACH methods!

I hope this information helps you conduct your business and receive funds from around the world in a much easier manner. This article will continue receiving updates as developments happen.

Thanks this is some excellent information.

Awesome 👏🏾

This is an excellent and well-researched article that is very timely. Thank you so much for putting this together.

I really appreciate your information.

I no longer live in the Caribbean.

How do I utilize the money I have in a Trinbago bank account while in Canada or USA?

Can I transfer funds from a T&T bank account to WISE account?

One can only access $200.00 usd daily with ATM card from T&T bank account.

Please advise. Your expose’ is most appreciated.

You are only limited to what you can transfer via Western union, Wire transfers at the bank and whatever you can load on a credit card.