INTRODUCTION — The End of Single-Stream Survival

Up until 2016, all I ever did was earn from a job. I didn’t plan to diversify my income — it just happened as the next evolution.

When I launched my first blog, Droid Island, I wasn’t thinking about building a business ecosystem or creating multiple revenue streams. I just wanted to share what I knew about smartphones — the gaps I saw in the Caribbean tech industry, the kind of content that nobody else was producing. But that one decision to create opened a door I didn’t even know existed. It led to e-commerce, workshops, brand deals, and consulting — and before I realized it, I was earning from five different sources without ever planning to.

That experience changed how I understood work. It proved that the traditional model — one job, one paycheck — isn’t security anymore. It’s vulnerability.

We live in an age where technology moves faster than job descriptions, and companies are restructuring faster than employees can retrain. The pandemic, AI, automation, and globalization all accelerated a simple truth: depending on one income stream is the new financial risk.

But here’s the thing — income diversification isn’t about quitting your job. It’s about reclaiming freedom, choice, and resilience in how you earn. It’s about designing a life where your livelihood doesn’t collapse because one employer, one client, or one algorithm changes its mind.

And this isn’t just theory anymore — it’s happening everywhere. According to Hostinger’s 2025 report, the global side hustle economy is now valued at $556.7 billion, with more than a third of U.S. adults earning extra income outside of their main job. The side hustle is no longer a side story — it’s the main character in the new economy.

As we move into 2026, income diversification isn’t just a trend; it’s becoming a baseline life skill. Whether you’re an employee, freelancer, or business owner, the question is no longer “should I have multiple income streams?” but rather “how efficiently can I build them?”

THE NEW PORTFOLIO OF INCOME STREAMS

How Modern Earners Balance Active, Passive, and Leveraged Income

The smartest earners in 2026 aren’t working harder — they’re structuring smarter. They treat income like an investment portfolio, balancing active, passive, and leveraged streams that work together to build long-term freedom.

According to Goldman Sachs Research, the global creator economy is valued at roughly $250 billion today and projected to approach half a trillion dollars by 2027. That growth isn’t just about influencers — it’s about teachers, consultants, and small business owners monetizing expertise through digital platforms. The IAB’s Creator Economy Report also confirms that this market has become one of the fastest-growing sectors in the digital economy, powered by micro-entrepreneurs rather than large media houses.

At the same time, PwC’s 2025 Global AI Jobs Barometer found that workers with specialized AI skills now command a 56% wage premium, showing how technology fluency directly translates into higher earning potential. Meanwhile, research from WeCanTrack (2025) projects that over 90% of businesses will integrate affiliate marketing into their sales strategy by 2026 — proving that digital monetization isn’t a niche trend anymore, it’s a baseline expectation.

For me, this transformation became personal once I stopped treating platforms as tools — and started treating them as digital assets. My website is the nucleus of my entire income ecosystem. It’s the place where I’m discovered through search, where my content builds trust, and where every transaction happens.

“My website isn’t just a website — it’s my storefront, my funnel, and my bank.”

The second pillar is my Digipreneur Academy, built on Thinkific — my on-demand classroom where I sell digital courses and workshops. These are my leveraged streams: products built once that continue to earn repeatedly without needing my daily presence.

Then there’s the active layer — my consulting, workshops, and speaking engagements. These are high-energy, high-reward activities that keep me connected to businesses while fueling my creative independence. They’re not just revenue; they’re visibility and credibility engines that expand my ecosystem.

Each stream feeds the other: the website drives discovery, the content builds trust, the academy monetizes expertise, and consulting reinforces authority. It’s a circular economy of my own design — one that earns across time zones, currencies, and audiences.

This is what income diversification looks like in 2026:

not juggling side hustles, but engineering a system where your ideas, assets, and audience work for you — long after you’ve logged off.

THE ROLE OF AI — The New Business Partner

How Artificial Intelligence Became the Engine for Personal Scalability

Artificial Intelligence isn’t replacing people — it’s replacing inefficiency. It’s the new leverage point for anyone who wants to scale their output without scaling their stress.

According to PwC’s 2025 Global AI Jobs Barometer, industries that have deeply integrated AI are seeing three times higher growth in revenue per employee than those that haven’t. That’s a direct signal that AI isn’t just about automation — it’s a multiplier of human potential. And the shift is accelerating fast: the skills required in AI-exposed industries are changing 66% faster than in sectors with low AI adoption.

What that means is simple — the value isn’t in using AI; it’s in understanding how to think with it.

For me, AI has become my first assistant. It allows me to work lean but play big — automating research, writing, data analysis, and audience insights so I can focus on strategy, storytelling, and the creative decisions that truly move the needle. I use it to draft article structures, summarize trends, and even map audience behavior, but the voice — the human touch, the strategy — still has to come from me.

That’s the secret of this era: AI doesn’t replace creativity; it scales it. The people winning right now aren’t the ones resisting it — they’re the ones learning to delegate to it.

For Caribbean professionals, this is where the opportunity — and the urgency — lies. The region has always been late to adopt new tools, often waiting for “proof” before acting. But this time, the window is closing fast. AI is moving so quickly that waiting to adapt could mean watching your competitive advantage vanish overnight.

The truth is, AI is the great equalizer for small markets like ours. It gives a solo Caribbean consultant or content creator the same power once reserved for a ten-person marketing team. It breaks barriers of geography, scale, and access. But only if we learn to use it before it replaces what makes us valuable — our creativity, our cultural insight, and our human voice.

In my business, AI doesn’t take jobs — it takes tasks.

And every task I automate gives me more time to build, create, and connect — the things no algorithm can replicate.

THE DIGITAL INFRASTRUCTURE — How to Get Paid Anywhere

The Backbone of Modern Diversification Is Mobility

If income diversification is the vehicle, digital infrastructure is the road that makes it possible. You can’t talk about financial freedom in 2026 without talking about how you get paid.

The real transformation of this decade isn’t just in how people earn — it’s in how easily they can move their money across borders. Fintech platforms like Wise, Payoneer, and Stripe have quietly become the new global banking system for creators, freelancers, and entrepreneurs who live outside traditional financial centers.

According to Payoneer’s 2025 Financial Efficiency Report, the company processed $82 billion in cross-border payments, growing 17% year over year, as millions of independent workers began exporting digital services worldwide. Meanwhile, Wise reported cross-border transaction volumes of £118.5 billion in 2024 — a 13% jump — proving that global earning is no longer limited to large corporations.

These tools have created an entirely new layer of digital sovereignty: the ability to earn in hard currencies, store value in multiple accounts, and spend globally without permission from local banks.

For me, this has been the foundation of my entire digital ecosystem. My website is the operational heart — it processes all payments through PayPal, while my Wise and Bank of America accounts hold and manage my USD income. Every cent that passes through my system is digital.

“I’ve been paid 100% digitally since 2017 — no cheques, no cash, no waiting on bank approvals.”

That structure gave me something most entrepreneurs in small economies never experience: control. It allowed me to detach from Trinidad & Tobago’s ongoing foreign exchange crisis, where TTD income is trapped within the country’s financial system. Once my business became fully digital, I stopped worrying about conversion limits and started thinking globally.

But the real insight isn’t just about escaping local constraints — it’s about building infrastructure that scales freedom.

Every Caribbean entrepreneur needs to start designing for borderless business. That means setting up platforms that process in USD, GBP, or EUR; maintaining at least one international account (like Wise or Payoneer); and owning digital real estate (your website) that doesn’t depend on local payment rails.

This is the foundation of modern income diversification:

You don’t just build income streams — you build financial pathways that connect you to the global economy.

Because the truth is, the next generation of Caribbean entrepreneurs won’t be fighting to get money out of the islands — they’ll be earning it from everywhere else.

TRUST, COMMUNITY, AND ATTENTION — The Real Currency

Why Relationships Now Outperform Reach

In the era of AI-generated everything, the rarest thing left online is trust. Anyone can automate a post or clone a voice — but not everyone can build credibility that converts. In 2026, attention is abundant, but trust is scarce — and that’s what makes it the most valuable asset in the new digital economy.

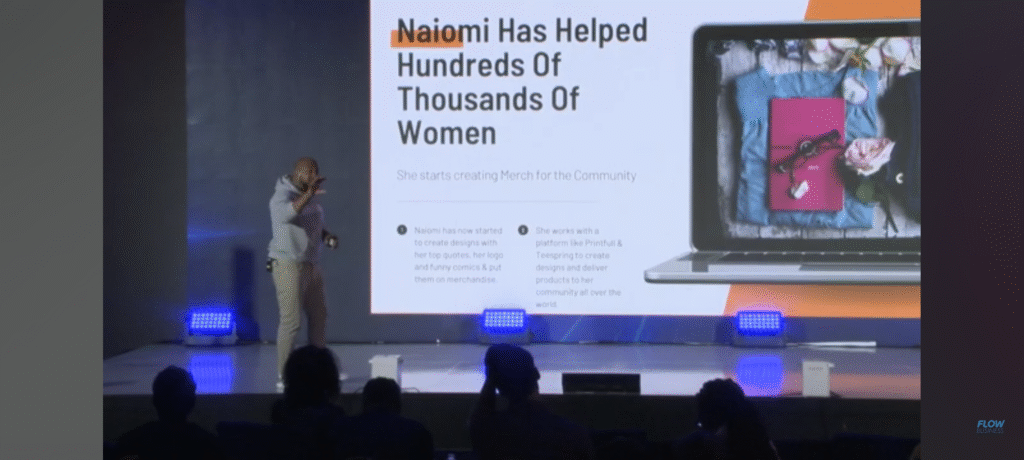

According to Inagiffy’s 2025 Community Monetization Report, the average paying community now charges $48 per month, and just 1,000 true members can generate nearly $48,000 in recurring monthly income. That’s proof that small, trusted communities are outpacing large, passive audiences. In fact, over 90% of paid networks earn additional income beyond subscriptions — through premium coaching, digital courses, and exclusive events.

That’s the power of attention anchored in trust.

For me, this lesson started back in the Droid Island days. Selling smartphones online in the Caribbean wasn’t just about product quality — it was about credibility. The region had been burned by fake sellers, shady deals, and “DM to order” hustles. So I had to do what Amazon and Walmart never had to: earn trust locally.

I showed up consistently, educated the public through blogs and videos, and made it easy for customers to buy securely through my website. Over time, that transparency built something no ad could buy — reputation equity.

“The Caribbean will buy from Amazon without blinking — but it took years to make them trust a local creator online.”

That same principle now drives my entire brand. Whether I’m teaching workshops, running my academy, or publishing content, I focus on value first, sales second. Because in a world where algorithms decide who’s seen, trust decides who’s believed.

And this is where the creator economy is maturing fast. It’s no longer about mass following; it’s about micro-trust ecosystems. Small, dedicated audiences that genuinely believe in your work — and are willing to pay for access, education, and deeper connection.

The AI revolution has made content easier, but it has also made authenticity priceless. Caribbean creators who understand this — who invest in community, conversation, and credibility — will outperform those chasing viral metrics every time.

As platforms like YouTube, Patreon, and Substack evolve into full-scale business models, community has become the new infrastructure of income diversification. It’s not just where you build engagement — it’s where you build stability.

So as everyone else fights for clicks, I’m doubling down on connection.

Because in 2026, likes won’t pay you — but loyalty will.

THE EMERGING MARKET REALITY — The Caribbean Context

Building Digital Wealth in Economies Still Catching Up

While the rest of the world races into AI-driven economies and borderless digital trade, the Caribbean still feels like it’s running on dial-up in a fibre-optic world. Our talent is world-class — but our infrastructure, policies, and mindset haven’t caught up to it yet.

Across emerging markets, digital platforms are becoming a lifeline for income diversification. The World Bank notes that hundreds of millions of people across Africa and Asia have gained access to digital payment systems and remote work opportunities that were unimaginable a decade ago. But in the Caribbean, progress has been slower — not because of capability, but because of access and regulation.

We still lack integrated payment rails like Stripe, Venmo, or Cash App, and even in 2026, Caribbean entrepreneurs can’t natively sell products through Instagram Shops or Facebook Marketplace. So while the global creator economy expands toward $500 billion, our regional creators are still forced to find workarounds just to get paid.

Yet — and this is where it gets powerful — the Caribbean has been quietly innovating through constraint.

We learned to build Shopify stores that accept PayPal, set up Wise accounts to receive USD, and teach clients how to transact online even when the platforms themselves weren’t designed for us.

“The world innovates through convenience — the Caribbean innovates through necessity.”

Those of us building digital businesses from the region have had to play both entrepreneur and infrastructure. We’re not just creating content; we’re educating markets, building trust, and proving that online transactions are safe. That’s what makes every Caribbean digital earner a pioneer — we’re building the foundation while we walk on it.

Still, the gap between ambition and policy remains wide.

Countries like Barbados and The Bahamas have experimented with digital nomad visas and fintech sandboxes, but most regional banks still operate with 1990s logic — treating online transactions like threats instead of opportunities. Meanwhile, our young creators and freelancers are finding ways to bypass those systems entirely, building audiences and earning in USD from clients and brands abroad.

That’s the irony: the Caribbean’s digital future isn’t waiting on policymakers — it’s being built by the people who stopped waiting.

For every regional entrepreneur still battling outdated payment systems, there’s a new generation quietly mastering YouTube monetization, AI-powered freelancing, global e-commerce, and education platforms. They’re using the same global tools as everyone else — but with the creativity, hustle, and cultural energy that make Caribbean entrepreneurs different.

The Caribbean’s opportunity isn’t in catching up — it’s in skipping steps.

We don’t need to replicate Silicon Valley or Singapore. We can build our own hybrid model — one where content, community, and creativity become our main exports.

Because when the infrastructure finally catches up, the pioneers who’ve been building through the struggle won’t just be ready — they’ll be unstoppable.

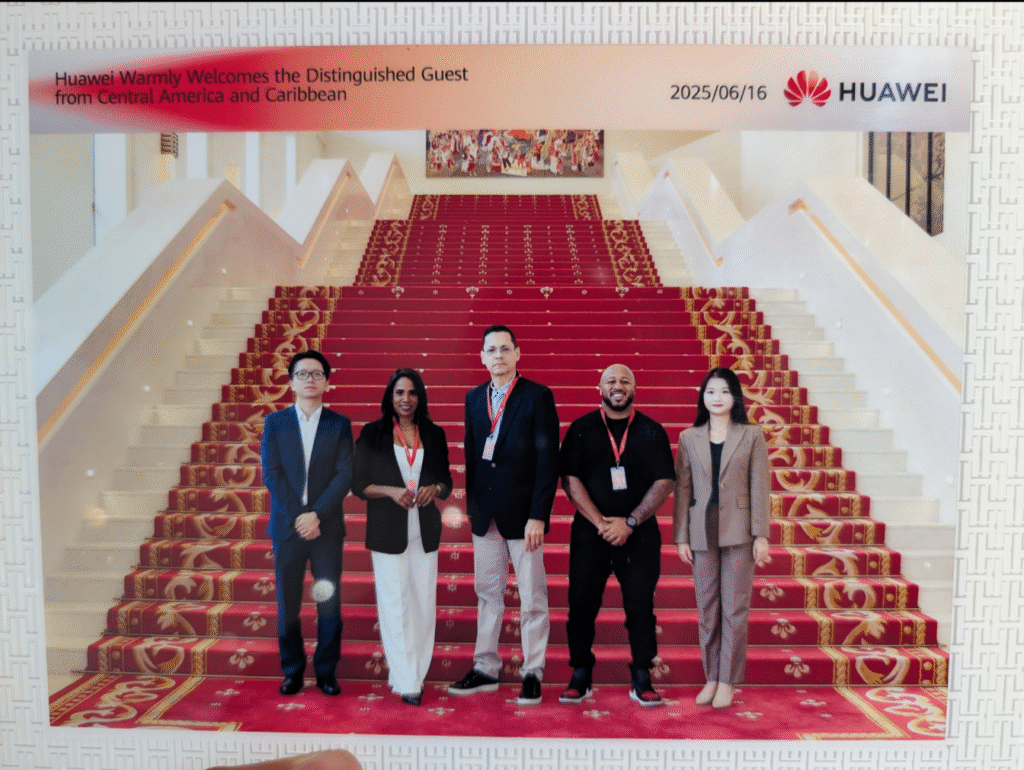

Huawei Innovation Center, Shenzen, China

YOUR PHILOSOPHY — The Lifestyle Business Mindset

Why Diversification Isn’t About Hustle, It’s About Harmony

Somewhere along the way, “entrepreneurship” became synonymous with exhaustion. The louder the hustle culture got, the clearer I became that I didn’t want any part of it. For me, income diversification isn’t about stacking more work — it’s about creating more space to live.

“I built a lifestyle business. I only say yes to projects that fit the life I want — not the other way around.”

That’s the mindset that changed everything. When I decided to build a business that served my life, not consumed it, everything aligned. The freedom to choose projects, clients, and creative directions became my definition of success.

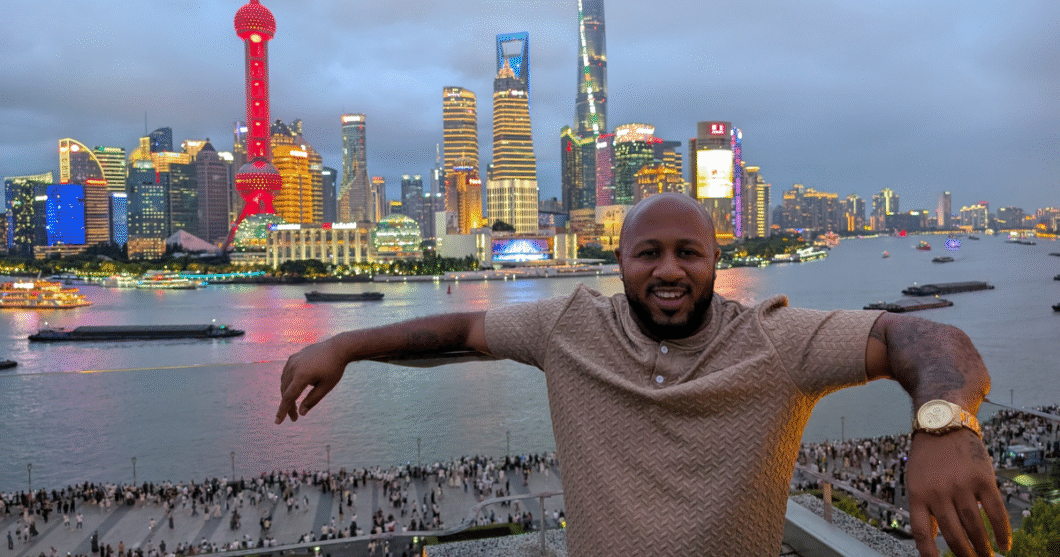

Thailand has been a big part of that shift. The lower cost of living has given me the breathing room to slow down, think deeply, and choose work based on purpose, not pressure. I don’t have to chase every dollar — I get to choose meaningful projects that stretch me intellectually and leave time for the gym, travel, reflection, and creating.

It’s a “work less, live more” philosophy, but not in a lazy way — in a strategic way. I built digital systems and leveraged income streams that continue to earn even when I’m offline. That’s the real luxury: freedom of time, energy, and attention.

As I look ahead to 2026, I’m stepping into a new phase of my evolution — creator economy immersion.

I want to dive deeper into the platforms shaping the next wave of global content creation: Douyin, Red Note, Kuaishou — platforms that are defining how digital influence and commerce intersect across Asia. There’s a lot the Caribbean can learn from these ecosystems — especially how creators monetize not just content, but culture.

At the same time, my focus is expanding from regional consulting to global digital education. I’ve realized that my mission isn’t limited to helping Caribbean businesses go digital — it’s to help anyone, anywhere in emerging markets understand how to build online ecosystems that generate income, opportunity, and independence.

This is the evolution of the lifestyle business — one that isn’t tied to geography or constant grind, but to clarity and impact.

Because in the end, diversification isn’t just about having multiple streams of income.

It’s about having multiple ways to live.

THE FUTURE OF DIVERSIFICATION — 2026 AND BEYOND

Designing Freedom in an Age of Acceleration

If the last decade was about discovering digital income, the next one is about engineering it. The era we’re stepping into isn’t just about having multiple income streams — it’s about mastering the systems, tools, and skills that make those streams scalable, sustainable, and smart.

According to IDC and Microsoft Cloud’s 2025 AI Transformation Report, global AI adoption is expected to create over $22 trillion in new economic impact by 2030. That’s not just corporate value — that’s opportunity being redistributed into the hands of small businesses, solopreneurs, and creators who know how to use AI as leverage. Every new AI platform, automation, or marketplace is a doorway for independent earners to capture a slice of that growth.

At the same time, the World Economic Forum’s Future of Jobs Report (2025) confirms that 85% of companies plan to upskill their teams in AI and digital tools, while 73% are using automation to enhance human capability — not replace it. The message is clear: the people who keep learning will keep earning.

We’re moving toward what I call the Portfolio Career Era — where your work life is a collection of roles, projects, and digital assets that evolve with you. You might teach online, consult for brands, sell digital products, and earn ad revenue — all while building a personal ecosystem that adapts faster than any employer ever could.

And for those of us from small economies like the Caribbean, that’s a powerful equalizer. We no longer need to wait on governments or global companies to “create opportunities.” The tools to build, earn, and scale are already in our hands — all we need is the digital literacy and financial infrastructure to use them.

But here’s the part most people miss:

The future of diversification won’t just be about more streams of income. It will be about smarter ones. Streams that are AI-assisted, automated, and asset-backed — designed to multiply without burning you out.

That’s where my own focus is headed: building systems that merge content, community, and automation into long-term financial freedom. Using AI to handle the repetitive, freeing up bandwidth for creativity and connection.

Because ultimately, the future of diversification is about control — not just over how you earn, but how you live.

And that’s the real transformation happening right now:

People are no longer chasing income.

They’re designing autonomy.

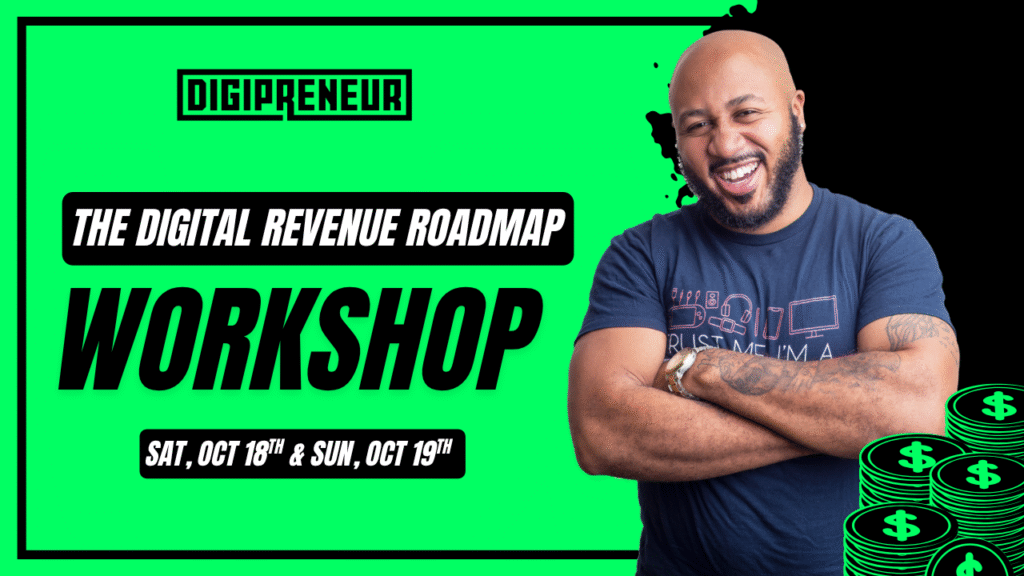

NEXT STEPS — The Digital Revenue Roadmap Workshop

Build Your Own Income Ecosystem

If there’s one thing this entire journey has shown, it’s that depending on one source of income isn’t just outdated — it’s dangerous. The world has changed, and the people who thrive in 2026 will be the ones who understand how to build income ecosystems that work across platforms, currencies, and borders.

That’s exactly what we’ll be doing inside The Digital Revenue Roadmap Workshop: How to Monetize Online in 2025, happening October Sat, Oct 18th and Sun, Oct 19th. The cost of the workshop is $45usd/$300ttd.

This workshop is your step-by-step blueprint for building the systems I’ve talked about throughout this article — your own diversified digital business model designed for freedom, not burnout. You’ll learn how to:

- Identify your unique digital income opportunities.

- Build a revenue roadmap that aligns with your skills, lifestyle, and goals.

- Set up the infrastructure — website, payment systems, and platforms — that turn your ideas into income.

- Develop a long-term strategy to scale sustainably through content, automation, and community.

This is the same process I used to build multiple income streams that now support my lifestyle business and global independence.

Your digital revenue roadmap will become your personal engine of freedom — the system that gives you your life back, protects you from economic uncertainty, and allows you to build real security on your own terms.

Because here’s the truth: this is how the Caribbean needs to start thinking heading into 2026.

We can’t wait for policy to catch up or institutions to modernize — we have to build our own digital wealth ecosystems, one creator, one entrepreneur, one small business at a time.

If you’re ready to stop relying on one source of income and start building your own digital future, join me for The Digital Revenue Roadmap Workshop on October 18th and 19th.

👉🏽 Register here: The Digital Revenue Roadmap Workshop

This is your chance to design the ecosystem that will power your next chapter — because in 2026, security won’t come from a paycheck.

It’ll come from the systems you build.