Most businesses in Trinidad and Tobago think they know their audience.

They assume they understand who their customers are, what they care about, and what kind of content will catch their eye.

But when you really look at what’s happening online… the data tells a different story.

Instead of strategy, most businesses are chasing trends.

Instead of research, they’re relying on gut feelings.

And when the content misses (which it often does), the fallback is to boost the post and spend ad money trying to force results—amplifying content that was never built on real audience insight in the first place.

That’s the cycle. And it’s costing Caribbean businesses money, relevance, and attention.

So I decided to show you what it looks like to do it differently.

Not with another marketing theory—but with something we all understand: roti.

Using real search data from Google, I set out to map who in Trinidad is looking for roti, what they’re asking, where the interest is strongest, and how different types of people are engaging with this iconic food online. The goal wasn’t just to study roti—it was to demonstrate how much insight we can uncover when we stop guessing and start listening.

Because once you understand your audience:

- You stop making content for the algorithm and start making it for people

- You stop wasting money on ads that target the wrong crowd

- You gain the clarity to create campaigns, offers, and strategies that actually land

This case study is a blueprint for what’s possible.

Whether you’re in food, fashion, fitness, finance, or anything else—the data is out there.

And when you know how to read it, it becomes one of your most powerful tools for growth.

Let’s take roti as the example.

Let me show you what the audience is already telling us.

Now we listen. Now we learn. Now we build smarter.

The Top Searches For Roti in Trinidad and Tobago

When we say “roti is culture,” the data agrees.

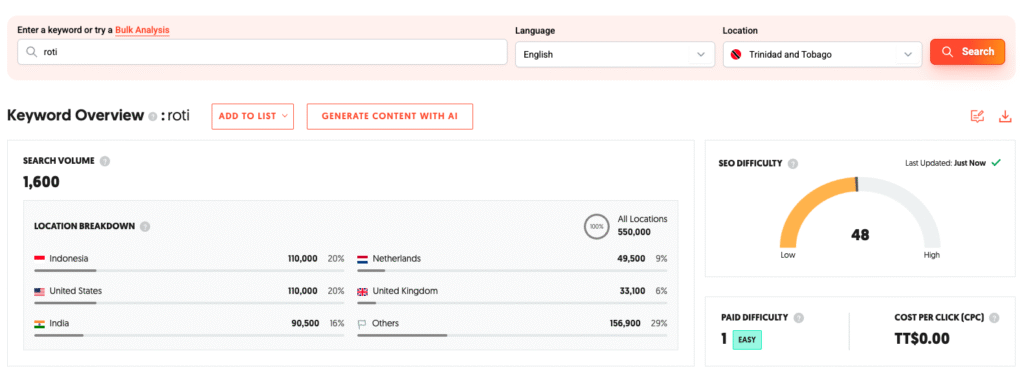

Over the past 30 days, there were 1,600 Google searches in Trinidad and Tobago for the term “roti.” That might not seem massive at first glance—but remember, this isn’t social media noise. These are deliberate search actions. People going to Google with intent. With questions. With cravings. With decisions to make.

What makes this even more interesting is the global context: roti sees over 550,000 searches worldwide, led by countries like Indonesia, the United States, and India. And yet, Trinidad & Tobago consistently ranks in the top 5 globally, which confirms something we’ve always known—Trinis don’t just eat roti; we live it.

So the real question is: what are we searching for when we think about roti?

🧠 What We Found in the Search Data

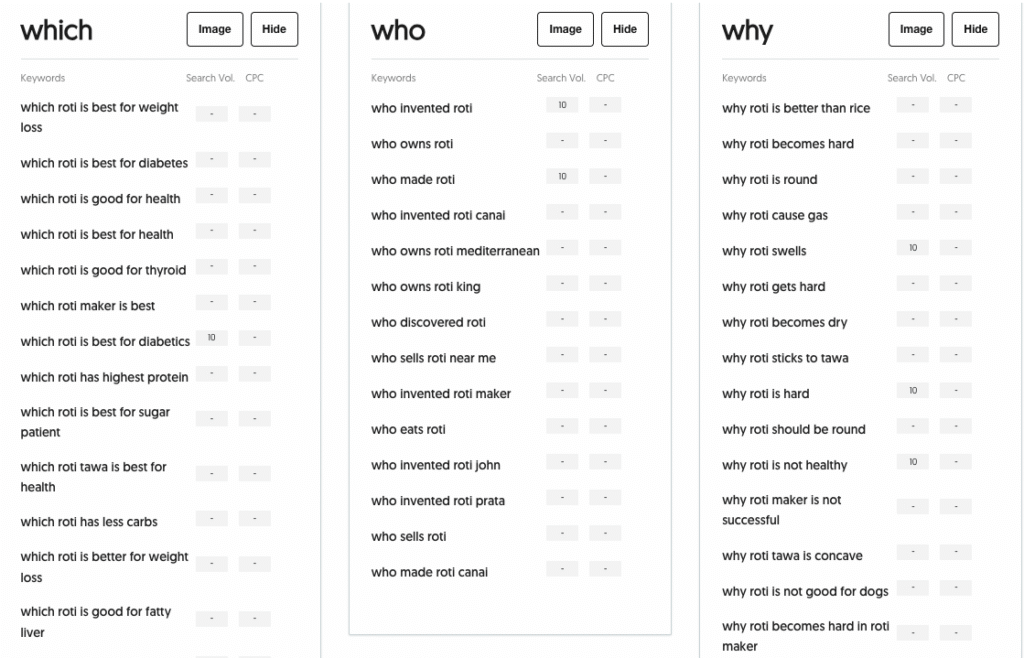

We analyzed all the top Google search questions for “roti” in Trinidad using real-time data from the past 30 days. We weren’t looking for fluff. We were looking for patterns. Curiosities. Buying signals. Gaps in knowledge. Things people want but aren’t easily finding.

And the insights were rich.

1. Intent-Driven Search: “Where” + “What”

The two most dominant search styles were location-based and informational.

– Where to buy dhalpuri roti in Trinidad?

– What is the difference between sada and paratha?

– Where to get buss-up-shut near me?

These queries are gold for local businesses. They reflect active interest in purchasing or comparing roti options, and signal missed opportunities for brands not optimizing for Google Maps, local SEO, or content that ranks.

If people are asking where to get it—and you’re not showing up—you’re invisible.

2. Cultural Curiosity: “What’s the Difference?”

People want clarity. Especially younger audiences or those returning from abroad. Many questions centered around understanding types of roti or ingredients:

– Is sada the same as naan?

– What’s healthier—dhalpuri or paratha?

– What makes buss-up-shut soft?

This shows that education is part of the buyer journey. If your audience doesn’t know the differences, they may choose based on price or brand recognition alone. But if you teach them, they’ll remember you. That’s where content wins.

3. DIY & Diaspora Behavior: “How to Make…”

A surprising number of searches focused on making roti from scratch—many without traditional tools:

– How to make sada roti without tawa?

– Can I freeze paratha?

– How to make dhalpuri soft?

These aren’t just domestic cooks—they’re part of a wider home-chef movement, driven by culture preservation, cost-saving, or pure culinary pride. There’s opportunity here for content creators, grocery stores, and even appliance brands to speak directly to this audience.

4. Meal Planning, Pairings, and Lifestyle Choices

Some searches weren’t about what roti is—but when, how, and why to eat it:

– Is roti fattening?

– Can I eat roti for breakfast?

– What goes well with sada?

This tells us something important: roti lives at the intersection of food, culture, and health. It’s not just a menu item—it’s a lifestyle decision. And with diet-conscious consumers growing, there’s an opening to market roti in new ways (e.g., high-protein options, vegan pairings, portion tips).

5. Gaps in Content and Discovery

One of the clearest signals in the data was this: Trinis are curious—but underserved.

Many of the questions have no local content ranking well. This means businesses are missing an opportunity to:

- Show up in search when people are ready to buy

- Create guides and “best of” content to build trust

- Use search behavior to influence what and how they promote

Imagine having this kind of insight before you run your next ad. Before you shoot your next reel. Before you choose your next promo. That’s the power of audience decoding.

🔦 Final Thought for Businesses

Every one of these questions is a breadcrumb. A signpost. A tiny moment of intent.

And when you start collecting them, analyzing them, and using them to shape your visibility strategy, you stop guessing—and start connecting.

This is what most Caribbean businesses miss. They jump straight to content creation, hoping a trending sound or a Carnival pun will carry the day. But the real traction comes when you start with the question—What are people already looking for?

Roti lovers are looking. And now you know exactly what they’re asking.

Where Are People Located in T&T Searching for Roti?

Who’s Really Searching for Roti?

When you understand what people are searching for, you get their curiosity.

But when you understand when and where they’re searching, you unlock their behavior.

So we turned to Google Trends—one of the clearest windows into real-time public interest. We wanted to answer two critical questions:

- Is roti a steady cultural staple or a seasonal craving?

- Which parts of Trinidad are most obsessed with it right now?

Let’s break it down.

🗓 Interest Over Time (Last 12 Months)

Roti searches in Trinidad and Tobago have been consistently strong over the past year, showing a steady rhythm with a few notable peaks.

One major spike occurred in early November 2024—suggesting a potential cultural or culinary trigger. This could align with events like Divali, when traditional East Indian dishes dominate kitchens and menus nationwide.

Outside of that spike, we saw a stable baseline of search activity throughout the year, with minor lifts around weekends and holidays. This tells us:

💡 Roti isn’t just trending—it’s embedded in everyday food culture.

🔄 Interest Over the Past 30 Days

Now, zoom in.

In the last 30 days, Google Trends shows that roti is still top of mind, with consistent searches from Monday to Sunday, and mild upticks on Fridays and Saturdays. This is likely tied to weekend meal planning and family gatherings.

There’s no drastic seasonal fade here. If anything, the short-term data confirms that roti isn’t just a holiday indulgence—it’s a weekly staple, especially in homes and kitchens that still lean traditional.

This is where businesses miss the plot: they wait until “food season” to promote, but the demand never truly stops.

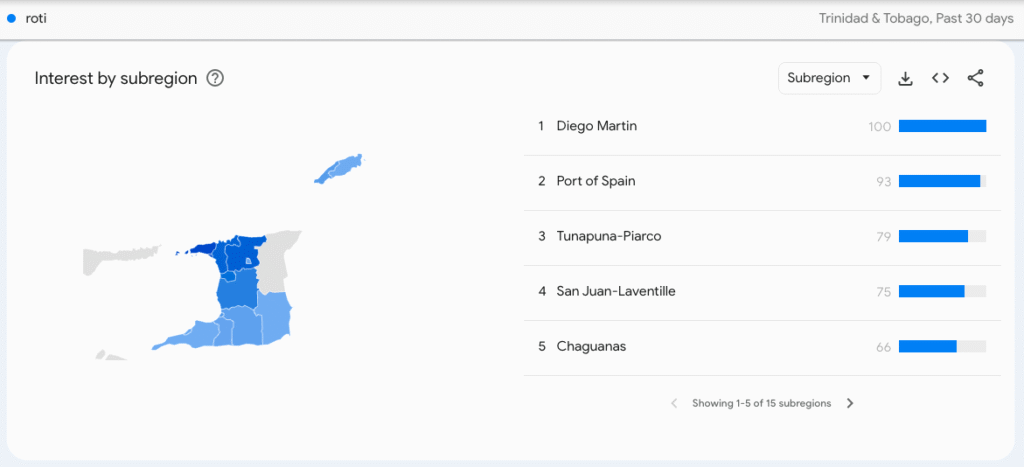

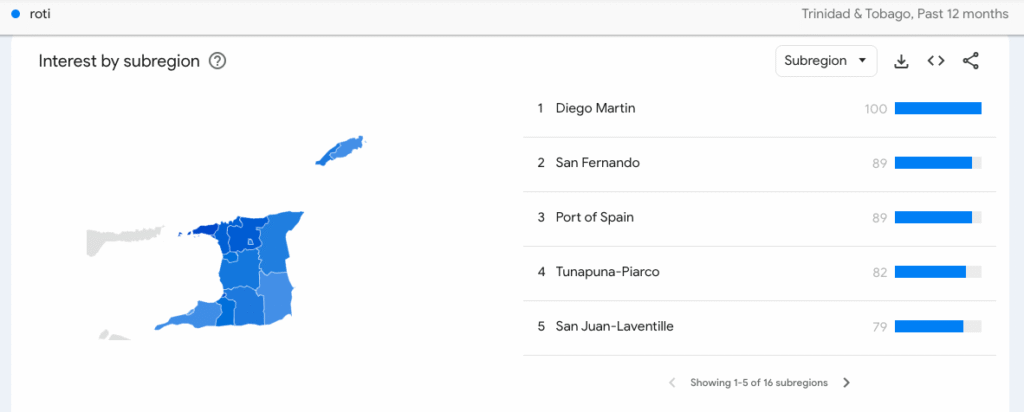

📍 Top Cities & Towns (Last 12 Months vs Last 30 Days)

Here’s where things get juicy: the regional heatmap.

According to the past 12 months of Google Trends data, the top cities and boroughs searching for roti were:

- Diego Martin

- Port of Spain

- San Fernando

- Tunapuna–Piarco

- San Juan–Laventille

This tells us that the urban North-West corridor dominates roti search behavior—especially Diego Martin, which consistently topped the list across all timelines.

Now, look at the last 30 days:

- Diego Martin (still #1)

- Port of Spain

- Tunapuna–Piarco

- San Juan–Laventille

- Chaguanas

Not only is the North-West still cooking, but Chaguanas is rising—hinting at renewed digital activity in central Trinidad’s food spaces.

And who’s surprisingly quiet?

Penal-Debe, Princes Town, San Fernando—areas historically known for Indian cuisine. This tells us something deeper:

💡 Digital visibility doesn’t always match real-world reputation.

🧭 What This Means for Businesses

If you’re selling roti, catering traditional food, running a doubles cart, or even making cooking content—you can’t rely on assumptions. You need city-level data.

Imagine:

- Targeting ads specifically in Diego Martin and Tunapuna

- Creating delivery content for Chaguanas’ growing demand

- Running promos before Divali when intent surges

- Using Friday/Saturday spikes to launch weekly “Roti Drops”

This is what decoding your audience looks like.

The next time you think you “know your people,” check the trends. The map never lies.

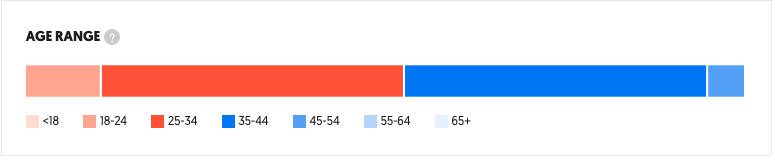

🧠 Beyond the Search Bar: Who’s Really Behind the Clicks?

Now that we know where roti searches are happening, let’s peel back the digital layer and dig into who’s doing the searching—and why that matters for anyone trying to sell, serve, or scale a roti-related business.

We combined our Google Trends city data with our Trinidad & Tobago Socioeconomic Research and our deep-dive Roti Cultural Report to paint a more accurate picture of each region’s consumer behavior.

Let’s go city by city.

1. Diego Martin

#1 in roti search activity—and not by accident.

📍 Profile: Upper-middle to high-income area with dense suburban development and one of the highest concentrations of professionals working in POS.

🧠 Implications:

People here love convenience. They’re not rolling buss-up shut from scratch. They’re looking for roti that’s hot, ready, and preferably available for pickup or delivery.

Businesses in this region should focus on premium presentation, digital ordering, and brand story. Think “elevated roti experience.” If you’re not online here—you’re invisible.

2. Port of Spain

📍 Profile: Urban capital. Mix of working professionals, foodies, expats, and corporate traffic. High mobile usage, fast-paced consumption habits.

🧠 Implications:

Port of Spain is searching during work hours and lunch breaks. This signals opportunity for:

- Corporate meal plans

- Quick pick-up lunch options

- Branded roti experiences near business districts

Content that performs well: clean food visuals, easy ordering, lunchtime promos, and food delivery convenience.

3. Tunapuna–Piarco

📍 Profile: Diverse socioeconomic mix. Includes UWI students, airport staff, middle-income families, and business commuters.

🧠 Implications:

This area has multiple buyer personas:

– Students looking for budget-friendly meals

– Airport workers seeking convenience

– Families craving weekend roti runs

You’re not targeting one type of customer here. Brands need segment-specific offers—meal boxes for students, bulk Sunday meals for families, fast mobile ordering for workers on-the-go.

4. San Juan–Laventille

📍 Profile: Densely populated, highly mobile, primarily working-class area. Known for entrepreneurial spirit, small eateries, and community markets.

🧠 Implications:

This group is digitally active but cost-conscious. They value deals, loyalty programs, and consistency.

Content that connects here?

– Price points clearly listed

– WhatsApp ordering

– “Who make the bess roti?” debates (social engagement)

– Community influencer endorsements

5. Chaguanas (Rising Star)

📍 Profile: Central Trinidad’s commercial heart. Fast-growing middle class, Indo-Trinidadian cultural base, and heavy food culture.

🧠 Implications:

Chaguanas is reclaiming its roti dominance online. The interest suggests digital behavior is finally catching up with cultural reality.

This is prime real estate for:

– Video content on roti prep and innovation

– Google Maps SEO for roti shops

– Cultural storytelling (Indo-Trini roots, family recipes, etc.)

⚠️ Underserved Regions: Princes Town, Penal-Debe, San Fernando

These regions have rich cultural ties to roti, yet low search visibility.

Why?

Possibilities include:

– Older demographics less active online

– Established local spots that don’t market digitally

– Community reliance on word-of-mouth

🧠 Opportunity:

If you’re a roti brand or food content creator in South, there’s room to dominate. The demand exists—but the digital presence doesn’t. Be the first to build search-optimized roti content for Southern audiences. Own the lane.

🔍 The Big Insight

When you combine Google Trends with regional socioeconomic data, you stop guessing and start understanding.

Because “Trinis love roti” isn’t a strategy.

Knowing that a working mom in Diego Martin wants clean branding, mobile ordering, and delivery by noon—that’s a strategy.

Knowing that a student in Tunapuna is scrolling TikTok at 11:30AM looking for a $30 roti deal—that’s leverage.

Knowing that a vendor in Princes Town is missing out on sales because they never claimed their Google Business profile—that’s an opportunity.

👤 Section 4: Audience Profiles – Who’s Craving the Roti?

Not all roti lovers are built the same. In fact, they’re driven by wildly different needs, mindsets, and moments.

Here are the four dominant customer profiles we uncovered in the Trinidad and Tobago market—rooted in Google data, regional context, and real cultural patterns.

1. The Convenience Craver

Location Focus: Diego Martin, Port of Spain

Age Range: 25–44

Demographic: Professionals, young couples, upwardly mobile

Motivations

– Too busy to cook

– Seeking quick lunch or dinner options

– Want it fresh, hot, and nearby

– Willing to pay more for speed + branding

Content/Ad Strategy

– Focus on delivery apps, pickup-ready meals, and visual storytelling

– Clear menu photos, 3-click ordering, and map-based directions

– Works well with IG Reels, WhatsApp ordering links, Google Business visibility

What They Google

– “Best roti near me”

– “Roti delivery POS”

– “Lunch options Diego Martin”

2. The Budget Foodie

Location Focus: Tunapuna–Piarco, San Juan–Laventille

Age Range: 18–34

Demographic: Students, gig workers, first-job earners

Motivations

– Always hungry, always broke

– Looking for value: big portions, small price

– Make decisions fast (based on price and peer reviews)

Content/Ad Strategy

– Use price-based promos, shareable memes, group combos

– Showcase affordability without looking “cheap”

– Leverage peer shoutouts and user-generated content

What They Google

– “Cheap roti Tunapuna”

– “Best buss up shut under $30”

– “Roti with curry deals TT”

3. The Cultural Loyalist

Location Focus: Chaguanas, Couva, Princes Town

Age Range: 35–64

Demographic: Indo-Trinidadian families, traditionalists, food purists

Motivations

– Looking for authenticity: roti must “taste like Granny own”

– Interested in tradition, technique, and cultural preservation

– Value family-owned businesses

Content/Ad Strategy

– Tell the story of the roti: origin, method, family legacy

– Feature elders, traditions, and Indo-Caribbean pride

– YouTube videos, blog posts, and local radio/print still matter here

What They Google

– “How to make dhalpuri”

– “Best traditional roti Central”

– “Homemade roti Chaguanas”

4. The Weekend Warrior

Location Focus: Across T&T, especially South and East

Age Range: 25–55

Demographic: Families, food explorers, weekend shoppers

Motivations

– Roti = Weekend ritual

– Searching for something new (doubles + roti spots, mixed meats, vegan options)

– Will travel for “bess roti”

Content/Ad Strategy

– Highlight weekend specials, variety platters, combos

– Feature roti as part of a “foodie day trip” or Sunday lime

– Use Google Maps SEO and TikTok food reviews

What They Google

– “Best roti spots Trinidad”

– “Where to eat in [region] this weekend”

– “Vegan roti TT”

🎯 Why These Profiles Matter

Each profile doesn’t just tell us what someone is eating—it tells us:

- How to reach them

- What they care about

- When and where they make buying decisions

- How to craft content and ads they’ll respond to

These aren’t just roti buyers. These are micro-markets, each requiring a different approach if you want to win hearts, clicks, and cash.

And now that we’ve decoded them—it’s time to translate this into what to create.

🧭 Section 5: Reading Between the Data – Overlaying the Research

To truly understand your audience, you can’t just look at what they search…

You have to understand who they are and why they’re searching in the first place.

That’s why we didn’t rely on just one dataset.

We conducted two separate deep-dive research reports:

- A Socioeconomic & Demographic Report on Trinidad & Tobago

This outlined income distribution, class structures, population densities, and digital behavior by city and region. It gave us the ground-level realities—where people live, what they earn, what their lifestyles may look like, and how access to resources shapes their daily decisions. - A Cultural & Search Behavior Report on Roti in Trinidad

This analyzed real-time Google search data across the last 30 days and 12 months—tracking what people are asking about roti, where the demand is highest, and what knowledge gaps exist in different areas. This showed us what people want, how they think, and how their intent changes based on region, age, and curiosity.

Now, in this section, we overlay the two data sets to uncover the bigger picture. This is where numbers become narratives. By layering socioeconomic patterns over cultural interest, we begin to see:

- Where the most digitally active food lovers are concentrated

- Which communities have the most untapped potential

- How economic class influences what people want from their roti experience

- And what kind of content, service, or offer will actually resonate

This isn’t just research—it’s a roadmap.

Let’s explore the Trinidadian digital landscape through the lens of roti, region by region, and unpack the psychology, behavior, and business opportunities that emerge when we see the full story.

The Deep Research Documents Used

Roti: A Deep-Dive on Trinidad & Tobago’s Culinary Icon

These deep-dive research documents were created using Google Gemini, trained with custom prompts to pull rich, contextual insights specific to Trinidad & Tobago. For the roti report, we explored its cultural significance, search behavior, evolving consumption patterns, and regional curiosities. For the digital landscape report, we asked Gemini to break down socioeconomic and demographic trends by city—highlighting income levels, digital adoption, class distribution, and urban segmentation.

Why does this matter?

Because deep research helps us move beyond surface-level data. It allows us to understand the story behind the stats—to see how culture, economics, and behavior collide in a digital-first world. This layered approach reveals opportunities most businesses overlook. It’s the difference between throwing out content and crafting strategy with surgical precision.

🧑🏽💼 Urban Affluence Drives the “Now Culture”

(Diego Martin, Port of Spain, Westmoorings, Maraval)

These are high-income, fast-moving communities. People here expect digital-first businesses. They use search to solve immediate problems:

- “Where to get buss up shut near me?”

- “Lunch delivery Diego Martin”

- “Roti + delivery options Port of Spain”

They don’t need roti—they want it to fit into their lifestyle. The Gemini research tells us that Diego Martin is among the top regions in income and mobile device usage. And the roti search data confirms it: they lead the digital demand.

🧠 Strategic Insight: If your roti shop isn’t findable, orderable, and beautifully branded online—you don’t exist to them.

👩🏽🎓 The Digital Hustlers of the East

(Tunapuna–Piarco, San Juan, Arima)

Our socioeconomic report shows these regions are home to working-class strivers, university students, and gig economy workers. The kind of people who are busy, mobile, and online all day.

The roti search queries coming from these areas?

- “Roti under $30”

- “Sada without tawa”

- “Where to buy flour for roti”

This isn’t foodie culture. This is stretch-the-dollar culture. But they’re tech-savvy and plugged in. If your brand offers value—and speaks their language—they’ll make you trend.

🧠 Strategic Insight: Don’t ignore this demographic just because their basket size is smaller. They are your amplifiers, your content spreaders, your virality. Feed their pride, not just their pockets.

🧓🏽 Legacy Meets Loyalty in the Heartland

(Chaguanas, Couva, Princes Town)

Culturally Indo-Trinidadian. Economically diverse. Rooted in tradition.

The Gemini data tells us this region is family-driven, food-centric, and deeply tied to identity. It also tells us older generations dominate these areas.

Now look at the roti searches:

- “How to knead dhalpuri dough”

- “Dhal vs channa for buss up”

- “Traditional roti recipe TT”

This is where cultural preservation and search behavior meet. They’re not just eating—they’re remembering, recreating, and protecting.

🧠 Strategic Insight: Content here needs to feel like home. Speak to heritage. Give them something worth passing down.

🧭 Underrated, Underrepresented, and Ripe for Digital Growth

(South Trinidad: Penal–Debe, Mayaro, San Fernando)

Despite these regions being some of the strongest culinary hubs in T&T, their online search activity for roti is surprisingly low.

Why?

Gemini data suggests:

- Older populations

- Less reliance on Google and digital platforms

- Higher word-of-mouth and local loyalty

But this also means huge digital whitespace. If a southern-based business invested in SEO, WhatsApp ordering, or Google Maps content—they could dominate.

🧠 Strategic Insight: The demand exists—it just hasn’t been captured. Businesses in these areas are leaving money on the table by not meeting their audience where they’re scrolling.

🧩 When the Two Research Lenses Align

When we zoom out and combine search intent with economic, cultural, and behavioral context, we go from “Who’s hungry?” to:

- Who’s searching and why?

- What can they afford and what do they value?

- Which regions are digitally dominant—and which are sleeping giants?

- Where are the hidden marketing gaps you can claim before your competitors?

This is how you build a marketing strategy rooted in reality—not guesswork.

This is what real data intelligence looks like.

And this is why we created the Audience Decoder.

📣 Section 7: Content & Marketing Strategy Tips

Turning Data Into Digital Impact

Now that we understand the audience, their motivations, and where they live digitally and physically—let’s talk execution.

The truth is: most Caribbean businesses don’t fail because of bad products.

They fail because of misaligned marketing.

They’re creating the right content for the wrong platforms, or pushing ads without understanding intent.

This section breaks down what works best, and why—based on the actual behavior we’ve uncovered.

🎥 What Content Types Work Best?

Based on the way people search and engage, here’s what performs best across the roti audience spectrum:

1. Short-Form Video (Reels/TikTok/YouTube Shorts)

- Why it works: It matches the urgency and curiosity of Convenience Cravers and Budget Foodies

- What to show: Behind-the-scenes prep, customer reactions, fast ordering flows, taste tests

- Pro Tip: Capture attention in the first 3 seconds. Text overlays matter.

2. Carousel Posts & Infographics

- Why it works: For explaining variety (menu options), locations, pricing tiers

- What to show: “Which roti is right for you?”, family combo breakdowns, regional comparisons

- Pro Tip: Use emotion + simplicity. Think memes, nostalgia, or “before you eat” guides.

3. YouTube + Long-Form Stories

- Why it works: Older, more traditional audiences (Cultural Loyalists) spend time on YouTube and Facebook

- What to show: Generational stories, recipe preservation, interviews with roti-makers

- Pro Tip: Don’t chase views—chase emotional resonance. These videos build long-term brand equity.

📲 Best Platforms for Distribution

Your platform strategy should match where each audience already spends their time. Here’s what the data shows:

| Audience Segment | Best Channels |

|---|---|

| Convenience Cravers | Google Maps, Instagram, WhatsApp |

| Budget Foodies | TikTok, Instagram, Twitter (X) |

| Cultural Loyalists | Facebook, YouTube, WhatsApp |

| Weekend Warriors | Instagram, YouTube, WhatsApp Lists |

🧠 Platform Tip:

Most roti businesses underestimate Google Maps and WhatsApp—but these are critical visibility tools, especially for locals searching in the moment.

🧠 Using This Data for Smarter Campaigns

Here’s how businesses can immediately turn this data into better campaigns:

✅ Smarter Targeting

Use location-based targeting in ads for Port of Spain, Chaguanas, Tunapuna, etc.

Layer in interests like “Caribbean cuisine,” “quick meals,” or “Trinidad culture.”

Refine age targeting based on which segment you’re focusing on.

📆 Strategic Timing

- Post lunchtime content between 10AM–12PM for the Convenience Craver

- Drop weekend meal offers by Thursday evenings for Weekend Warriors

- Publish cultural content or recipe stories on Sunday mornings or weekday evenings

📣 Campaign Angles That Work

- “Roti for Every Budget” (Budget Foodie)

- “Taste Like Grandma Used to Make” (Cultural Loyalist)

- “Lunch Sorted in 3 Clicks” (Convenience Craver)

- “Where to Eat This Weekend” (Weekend Warrior)

🔑 The Real Takeaway

Marketing shouldn’t be a guessing game.

When you understand how your audience thinks and behaves, content stops being a struggle—and becomes a tool for connection, relevance, and revenue.

This research is your cheat code.

You don’t need to go viral.

You just need to show up in the right place, with the right message, for the right people.

Section 8: Final Thoughts + Call to Action

What This All Means for You as a Business Owner

We started this case study with one simple question:

How well do you really know roti lovers in Trinidad & Tobago?

But as we peeled back the data—layer by layer, city by city, search by search—what we really uncovered was how little most businesses actually know about their digital audience.

Most brands are:

- Creating content based on guesswork or trends

- Spending ad money to boost underperforming posts

- Hoping to get traction without truly understanding who they’re speaking to

But what if you had the data?

What if you knew:

- What your audience is asking Google right now

- Where the highest demand is coming from

- Which age groups are craving which type of content

- And how your product shows up in that ecosystem—or doesn’t

That’s the power of digital research done right.

That’s what the Audience Decoder was built for.

🎯 So What Can You Do With This?

- Craft smarter content that speaks to real needs, not just reels

- Launch campaigns that are aligned with age, city, and cultural behavior

- Use search and behavioral data to improve your ad targeting, your SEO, your product positioning, and your brand storytelling

If we could uncover this much from a single product—roti—imagine what we can discover about your business, your industry, your audience.

🔍 Ready to Decode Your Audience?

If you want to stop creating content in the dark, if you’re tired of wasting money on guesswork, and you’re ready to build smarter strategies based on actual data from your region, your market, your customers—

The Audience Decoder Report is your next move.

I’ll do the research. I’ll analyze the data.

And I’ll break it down into insights and action steps you can understand and use.

📩 You’ll get a fully customized report within 48 hours.

🔗 Click here to order yours: https://keronrose.com/product/audience-decoder-report

Your audience isn’t a mystery.

You just haven’t decoded them yet.

Let’s fix that.

This was a fantastic and insightful read.